The Nasdaq Index is one of the most popular and widely recognized stock market indices in the world. It plays a crucial role in tracking the performance of the stock market, especially in the United States. In this article, we will explore what the Nasdaq Index is, how it works, and why it is important for investors and traders alike.

What is the Nasdaq Index?

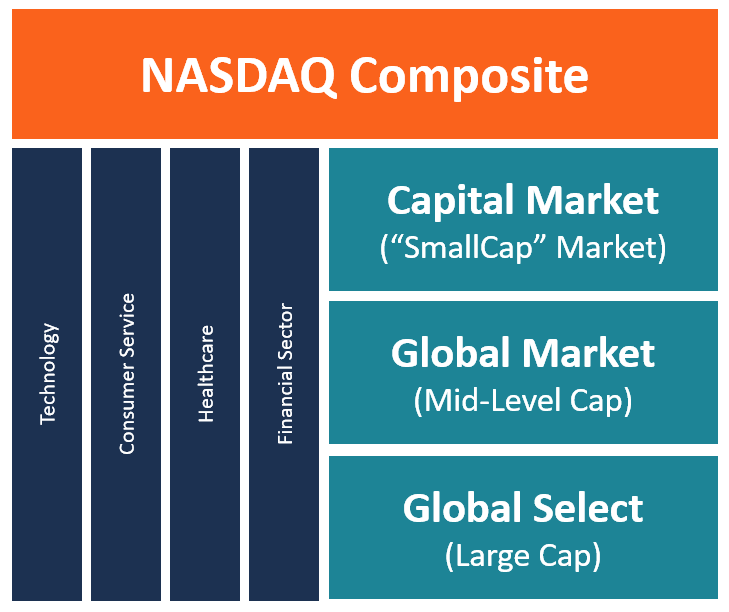

The Nasdaq Index refers to a collection of stocks that are traded on the Nasdaq Stock Market. It includes many companies, particularly in the technology sector. The index is often used to gauge the overall performance of the market, especially the tech industry. The Nasdaq Index is managed by Nasdaq, Inc., and it includes thousands of companies from various sectors like technology, healthcare, and consumer goods.

The Nasdaq Index is sometimes confused with the Nasdaq Composite Index, which tracks the entire market of stocks on the Nasdaq Stock Market, including both small and large companies. There is also a Nasdaq-100 Index, which focuses on the 100 largest non-financial companies listed on the Nasdaq.

Key Features of the Nasdaq Index

-

Technology Focused: The Nasdaq Index has a high concentration of tech companies, making it different from other stock market indices like the Dow Jones or S&P 500. Big companies like Apple, Microsoft, Amazon, and Google are included in the index. These companies are leaders in the tech world, and their performance can heavily influence the Nasdaq Index.

-

Market Performance Indicator: The Nasdaq Index is used as a barometer for the health of the overall market, especially in technology. When the Nasdaq performs well, it is often seen as a sign that the tech industry is thriving.

-

Diverse Companies: While the Nasdaq is known for its technology companies, it also includes firms from other industries like health care, finance, and consumer products. This makes the index more diverse than it might first appear.

-

Stock Price Weighted: Unlike some indices that are based on market capitalization, the Nasdaq is a price-weighted index. This means that the price of a stock plays a bigger role in determining how much influence it has on the index. For example, a company with a higher stock price has more impact on the movement of the Nasdaq Index than a company with a lower stock price.

Why is the Nasdaq Index Important?

The Nasdaq Index plays a vital role in the world of finance and investing. Below are some key reasons why it is important:

-

Tech Industry Performance: Since many of the world’s largest tech companies are part of the Nasdaq Index, the performance of the Nasdaq is often seen as a reflection of the health of the tech industry. If the Nasdaq is rising, it is a good indicator that tech companies are doing well.

-

Investment Opportunities: Investors use the Nasdaq Index to find investment opportunities in the stock market. By tracking how the Nasdaq is performing, they can decide when to buy or sell stocks. Many exchange-traded funds (ETFs) and mutual funds also track the Nasdaq Index, allowing investors to invest in a broad range of companies with just one fund.

-

Economic Indicator: The Nasdaq Index is also used as a tool to measure the overall health of the economy. When the Nasdaq is rising, it often means that businesses are growing, and people are spending more money. On the other hand, when the Nasdaq falls, it may suggest that the economy is slowing down.

-

Global Influence: Because many of the companies listed on the Nasdaq are global players, the index has a far-reaching influence. The performance of the Nasdaq can impact markets around the world. For example, if the Nasdaq falls sharply, it can cause other stock markets to follow suit, affecting investors and economies globally.

How is the Nasdaq Index Calculated?

The Nasdaq Index is calculated by using a method called market capitalization. This means that the total value of all the companies in the index is taken into account to determine the index’s overall performance. Market capitalization is the total value of a company’s outstanding shares of stock, calculated by multiplying the stock price by the total number of shares.

Each stock in the Nasdaq Index is weighted based on its market capitalization. Companies with higher market caps have a larger impact on the movement of the index. For example, a company like Apple, with a high market capitalization, will have more influence on the Nasdaq Index than a smaller company with a lower market cap.

The Nasdaq Composite Index tracks all the companies listed on the Nasdaq stock exchange, which is over 3,000 companies. The Nasdaq-100 Index, on the other hand, only includes the top 100 non-financial companies listed on the Nasdaq.

The Role of Technology in the Nasdaq Index

:max_bytes(150000):strip_icc()/GettyImages-1751833779-8e16daf8600340c8a107fb79d7fe3117.jpg)

As mentioned earlier, the Nasdaq Index is heavily weighted toward technology companies. This gives it a unique role in reflecting the performance of the technology sector. Over the years, the technology sector has grown significantly, and many of the most influential companies today, such as Apple, Microsoft, and Google, are part of the Nasdaq Index.

This technology-driven focus means that the Nasdaq is more volatile than some other indices. Tech companies are often subject to rapid changes in their business environment, such as innovation, competition, or regulatory challenges. Therefore, when these companies experience big swings in their stock prices, the Nasdaq Index can also experience sharp movements.

Nasdaq Index: A Benchmark for Investors

Major share of voice investors look at the Nasdaq Index as a benchmark for their investment strategies. If the Nasdaq is doing well, many investors feel confident in their investments in tech stocks. Similarly, when the Nasdaq falls, investors may reconsider their positions, especially in tech stocks.

In addition to individual investors, large institutional investors, such as pension funds and mutual funds, also track the Index. Some may even invest in funds that mimic the index, buying shares of the companies listed on the Nasdaq to achieve similar returns.

Crashes: What Happens When the Index Drops?

While the Nasdaq Index has seen tremendous growth, it has also faced significant crashes in the past. A crash occurs when the index drops sharply over a short period. Usually due to bad economic news, market panic, or sudden changes in market conditions.

One of the most notable crashes in recent history was the Dot-com Bubble in the early 2000s. During this period, many tech companies saw their stock prices soar. Only to crash later when investors realized that many of these companies were overvalued. The Index lost a significant portion of its value, but it eventually recovered as the tech industry continued to grow.

Another example of a major downturn for the Nasdaq came in 2020, when the market was affected by the COVID-19 pandemic. The pandemic led to a brief but sharp fall in stock prices, including the Nasdaq. However, the index rebounded quickly as tech companies like Zoom, Amazon, and Microsoft benefited from the rise in remote work and online shopping.

Despite these crashes, the Nasdaq has consistently recovered and continued to grow over the long term. Making it a popular investment option for those looking to tap into the potential of the tech sector.

How to Invest in the Nasdaq’s Index

Investing in this can be done in several ways. One of the most common ways is through Exchange-Traded Funds (ETFs) that track the index. Some popular ETFs that track the Nasdaq Composite or Nasdaq-100 include:

- Invesco QQQ ETF

- iShares Nasdaq-100 ETF

- First Trust Nasdaq-100 Equal Weighted ETF

By purchasing shares of these ETFs, investors can gain exposure to a wide range of companies that are part of the Nasdaq Index. This is an easy and low-cost way to invest in the Nasdaq without having to pick individual stocks.

Another way to invest in this by buying stocks of individual companies that are part of the index. However, this requires more research and knowledge about the companies within the Nasdaq. Investors should look for companies with strong growth potential and a solid business model to make informed decisions.

Index and the Global Economy

As the world’s largest stock exchange for tech companies, the Nasdaq Index plays an important role in the global economy. Many of the companies listed on the Nasdaq have a worldwide presence. And their success has a ripple effect on markets outside the United States.

For example, when Apple or Microsoft releases a new product. It can impact not just the American market but also markets in Europe, Asia, and beyond. This interconnectedness makes the Nasdaq Index an important gauge of global economic health.

In conclusion,

The Nasdaq Index is a vital part of the financial world. Particularly for those interested in the performance of the technology sector. If you are an investor, a trader, or someone who is simply interested in market trends. Understanding the Nasdaq Index is crucial. It helps you monitor the performance of major tech companies, track the economy, and even make informed investment decisions.